I use a system that has worked for over a hundred years.

An investing philosophy that has shown outstanding returns since the 1930s and it was developed for small investors like you and me. I'd spend the last 15 years focused in understanding why some people make so much money and others so little. I wanted to replicate whatever worked.

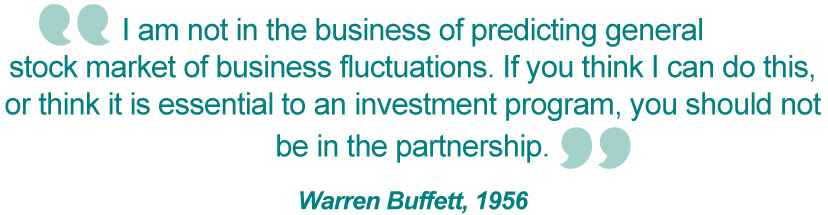

That’s when I came across the story of Warren Buffett, considered the best investor in the world. I wanted to understand how he could make this happen:

• Age 21: net worth $20.000

• Age 26: net worth $140.000

• Age 32: net worth $450.000

• Age 34: net worth $1.800.000

• Age 43: net worth $34.000.000

• Age 48: net worth $100.000.000

•…

•Age 88 : net worth $88.600.000.000 (2 times the Gross domestic product of Bolivia, almost as much as Ecuador. In fact more that 67% of countries that year).

Buffett earns only $100,000 a year at Berkshire Hathaway and spends it frugally.

Notice most of his wealth compounded after 52.

Not only that, but in his 20s he decided to become really rich to give it all away, becoming one of the biggest philanthropists ever. As a consequence of some of his donations, he has helped contribute to saving lives through vaccines and other initiatives in the Gates Foundation (he didn't even wanted his name on the foundation, imagine that!) And he had fun while doing it. What an extraordinary life!

I wanted to model Buffett, but I needed to understand how he did it. I read everything I could about the man, and his investment philosophy, 15 years ago there was not as much information as there is today. I had to decipher, investigate. What he did, would work today? If so... how?. If I could achieve 1% of what he did!

I developed a habit of reading a book a day (took me years to get there), but I knew that's what he did, so I started doing it... 500 pages.

I went so far as to buy really old books to look at the financial statements of investments he had make 50 years ago. I wanted to see what he saw. And slowly, but surely, I started understanding.

Here is what Buffett did. He saved, and invested at 20% compounded a year. Year in and year out all he did is just 20% better than last year. And that my goal too. Some years well see gains big gains, some years we will lose money, is impossible to tell when. But all I want to do through the years is that little 20% better than last year.

If that makes sense to you, as it does to me, I want to welcome you!

Believe it or not we use a strategy that was popularized by Benjamin Graham (Buffett's teacher) almost a hundred years ago. And still works!

Of course the fund wont only stick to this one strategy.

What Buffett used to do in the early years of his partnership (when he had his best returns on investment by the way) was to buy undervalued stocks. We are looking for very small companies, that are sell at a discount to the cash in the bank.

This means that we only invest in companies that have cash for $1'000.000 and are selling at a discount for example $600.000. The business, property and plants, intellectual property, etc. That all comes for free! This companies don't go broke because they have very little or no debt. They still can fail that's why we create a portfolio.

Graham suggested buying a portfolio of companies valued this way:

● Cash is valued at 100%, since a dollar in cash is worth a dollar.

● Receivables are valued at around 80% of their book value.

● Inventories are valued at around 66% of their book value.

● Long term assets valued at roughly 20% of their book value.

● Then, subtracting total liabilities.

This allow us to keep capital save and secure as our first goal, and then become profitable.

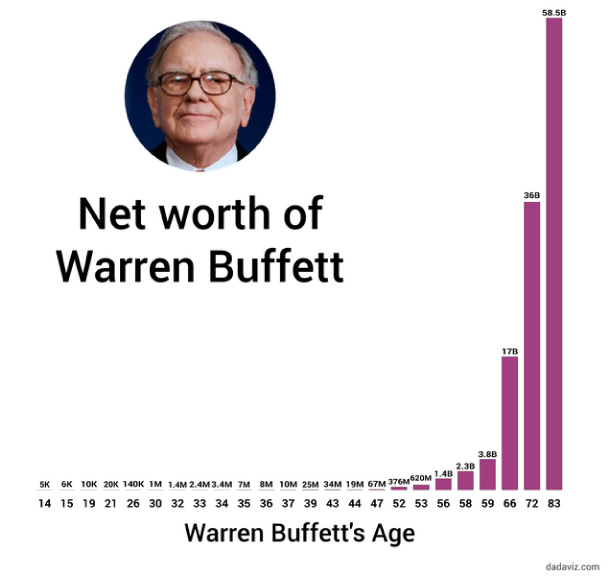

So our portfolio is just starting on 2020 and so far we are doing as expected. However here is a study that i found from the 80's https://www.jstor.org/stable/4478980?seq=1 that shows the strategy very well.

The point of this slide is that you realize the distribution of returns can vary a lot, depending on the year. Retiring money on a bad year is exactly what shouldn't be done, and how people lose money with this.

This strategy makes sense because

1) Focuses in the preservation of capital, that makes it safe and secure.

2) Focuses on long term investing (which makes it more predictable).

3) Has extraordinary rates of return in the long term.

4) It has a proven track record