Value Investment Fund, INC.

What you should know about the fund:

In each annual letter, I will try to honestly assess the fund’s performance, reiterate my core investment philosophy, and share my thoughts on various issues.

I share some of the fund’s holdings this year and explain my thoughts behind each one. This way you can get a better idea of where, why, and how we invest, and why I am very confident about the prospects of the fund.

However, there will be times I do not mention some positions. Nor do I mention the size of the position. When more people find these (mostly small) companies, the price of the stock can move abruptly.

To entertain/educate friends, family, and investors, I have created a podcast and a blog.

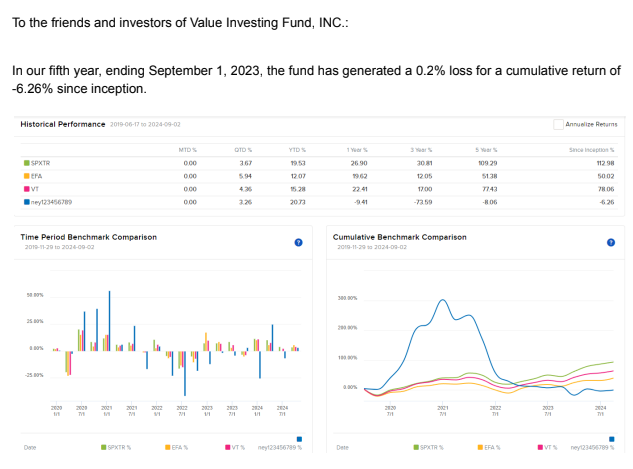

In our fifth year, ending September 1, 2023, the fund experienced a 0.2% loss, bringing our cumulative return to -6.26% since inception.

These have been challenging years, but I remain committed to most of our initial investments. In fact, I welcome lower prices, as they allow me to acquire more shares at better value. However, adopting this approach requires discipline and confidence in our research. This journey isn’t without difficulties—if it were easy, anyone could do it.

Every day, I think about my investors and deeply appreciate the trust they’ve placed in me. I want to remind you that my own money is invested in the same portfolio, and just like you, I’m on the same path—we’re all in this together. I especially value the support I’ve received, considering that in the early years we were close to a 400% gain. I’m convinced those days will return, and when they do, it will be swift and significant.

If our portfolio doesn’t reach new highs, I don’t believe it would be right for me to profit, and I’m committed to continuing to work for free, as I have over the past few years, until we achieve the results we all deserve.

Sincerely,

Ney Torres

Portfolio Manager

Value Investing Fund, Inc.